Impact

Financial Savings For Your Family

The Utah State Legislature’s tax reform plan restores the sales tax on food, but it also lowers the state income tax rate, expands the dependent exemption tax credit, and creates a grocery tax credit. So, a Utah family of four making $60,000 a year, will still save about $400.

Improved Funding For Those In Need

The State of Utah funds not only education and transportation, but air quality, public safety, and public health programs. Right now, Utah’s budget is short $64 million. This proposed tax reform plan will fully fund these vital programs while decreasing the tax burden on the middle class.

Prioritization of Education Funding

When it comes to education funding, the state’s hands are tied by a weakening state sales tax. Under this new tax reform plan, the Legislature will have the flexibility needed to fully fund public education regardless of outside economic forces.

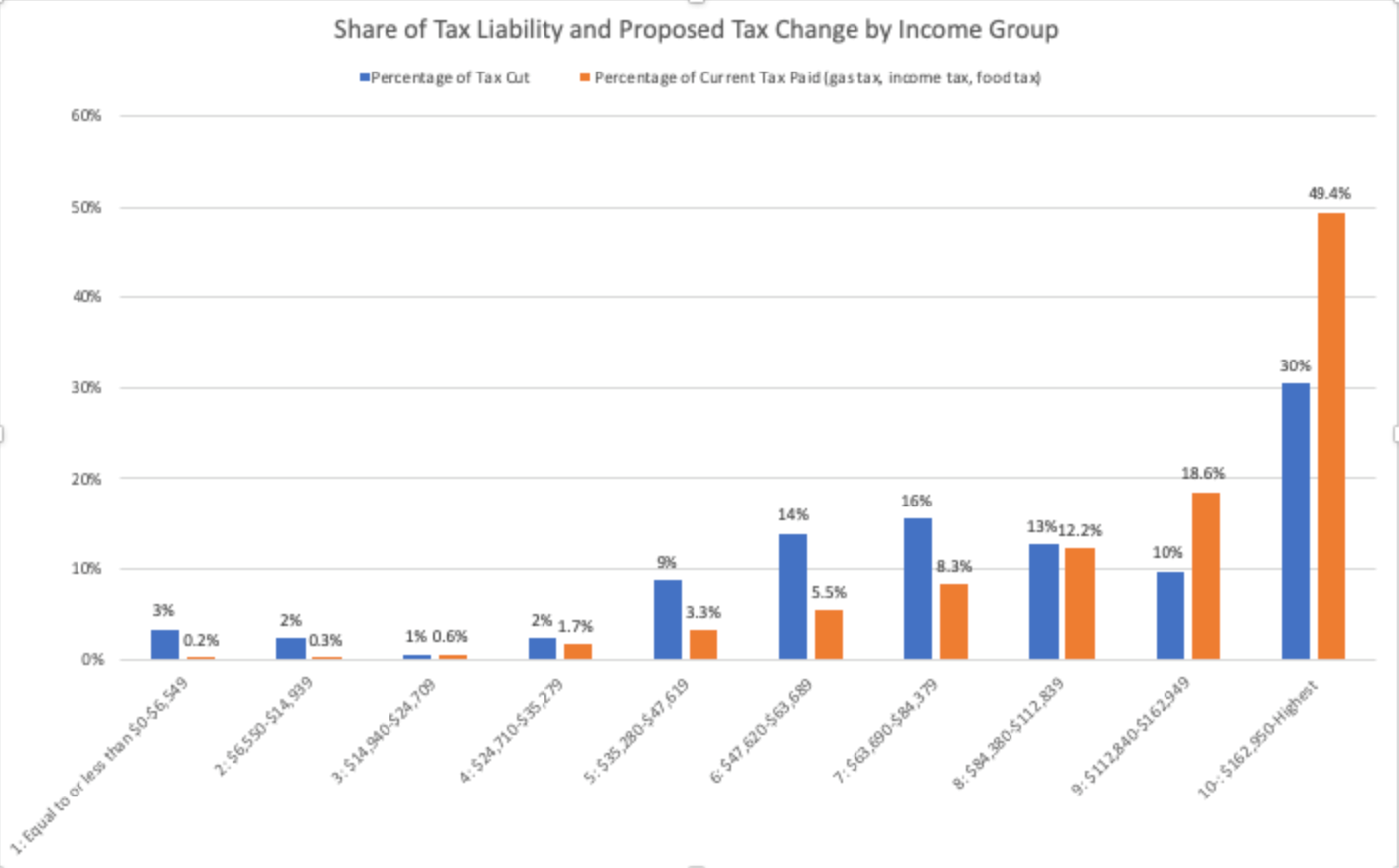

A Break For Those Who Need It Most

This current tax reform proposal is designed to ease the tax burden of Utah’s working families. This is not a tax cut for the wealthy; one of the proposal’s main goals is stabilize the state’s funding source without burdening the middle class. Utah’s middle class families will receive the bulk of the tax relief.